WHY APARTMENTS

WHY APARTMENTS

Apartments have historically outperformed stocks & bondsTo Your Portfolio

Investing in apartments is a smart move for those who want to avoid high-risk investments. Not only can multifamily investments bring fantastic equity growth but can provide monthly income that can be greater than what you would get from stocks and bonds, making it an even better choice if your goal is maximizing returns on investment while minimizing riskiness of your portfolio!

Multifamily investments have historically outperformed other Real Estate classes

Apartments have also been the best investment amongst all other Real Estate Classes. Because of the nature of multifamily properties and because of the way we structure our investment properties able to make significant cashflow plus equity growth which in turn yields higher overall returns than all other real estate asset classes.

Apartments have historically outperformed stocks & bondsTo Your Portfolio

Investing in apartments is a smart move for those who want to avoid high-risk investments. Not only can multifamily investments bring fantastic equity growth but can provide monthly income that can be greater than what you would get from stocks and bonds, making it an even better choice if your goal is maximizing returns on investment while minimizing riskiness of your portfolio!

Multifamily investments have historically outperformed other Real Estate classes

Apartments have also been the best investment amongst all other Real Estate Classes. Because of the nature of multifamily properties and because of the way we structure our investment properties able to make significant cashflow plus equity growth which in turn yields higher overall returns than all other real estate asset classes.

Take Advantage Of Increased Tax Benefits

Our Team only acquires stabilized (above 80% occupancy) and cash flow positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

Take advantage of 3 types of depreciation that allow investors to lower taxes:

1

Standard or Straight-line Depreciation

2

Accelerated Depreciation

3

Bonus Depreciation

Cost segregation studies are performed on all of our assets and the tax benefits pass through to our investors via annual year end reporting on K1s that are issued for the preceding year.

Take Advantage Of Increased Tax Benefits

Our Team only acquires stabilized (above 80% occupancy) and cash flow positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

Take advantage of 3 types of depreciation that allow investors to lower taxes:

1

Standard or Straight-line Depreciation

2

Accelerated Depreciation

3

Bonus Depreciation

Cost segregation studies are performed on all of our assets and the tax benefits pass through to our investors via annual year end reporting on K1s that are issued for the preceding year.

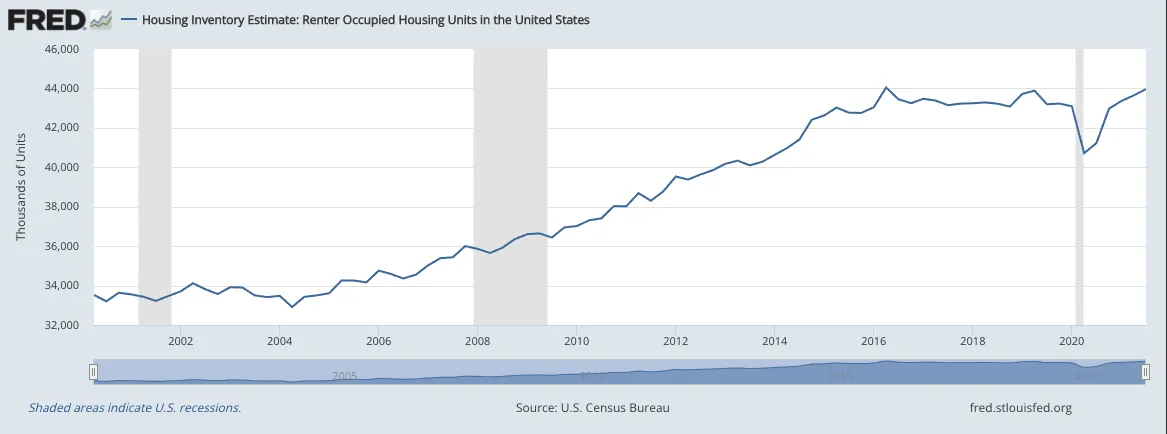

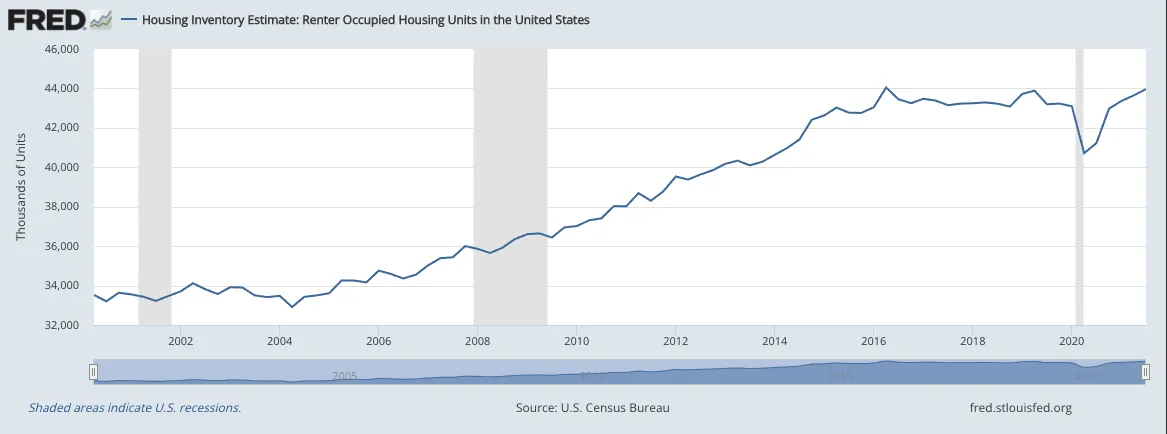

Demand for apartments is at an all-time high and still climbing

Since its peak in the mid-2000s (see graph below), home ownership has been significantly dropping and it will continue to drop as millennials and the aging baby boomers want to stay mobile in the 21st century.

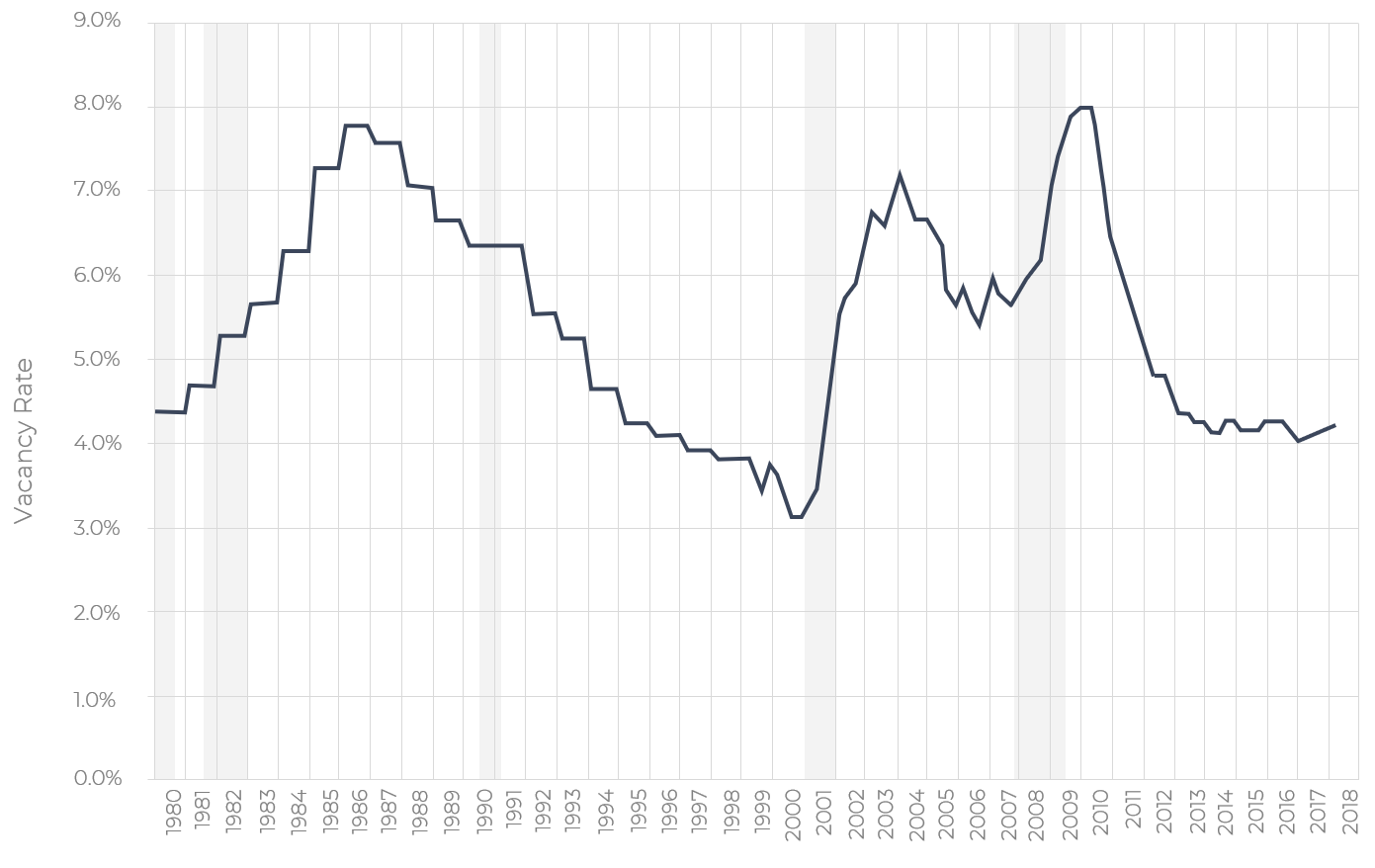

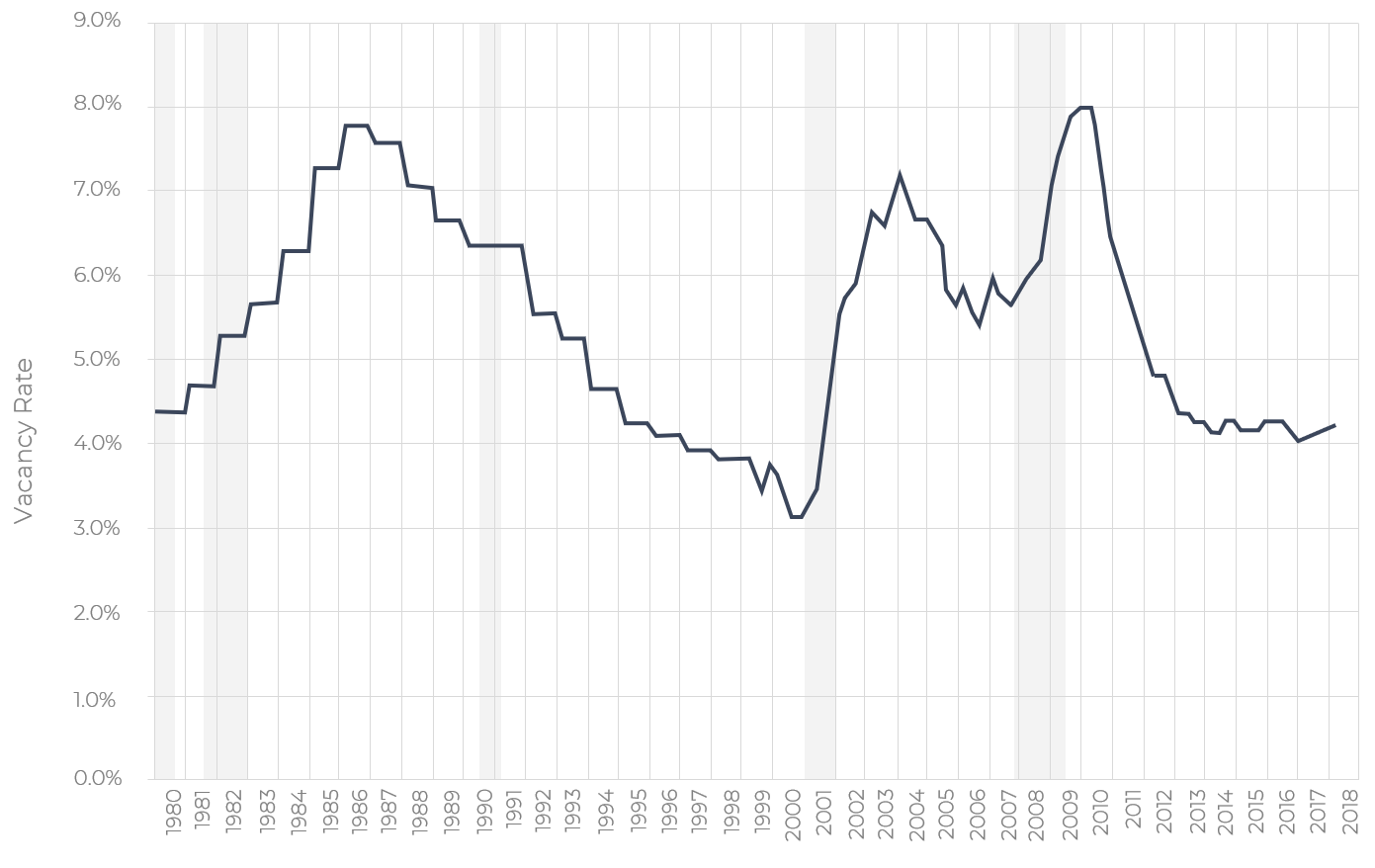

Vacancy rates remain low due to increased demand

With demand for apartments is at an all-time high, population is continuing to increase which drives the demand for apartment living higher and higher. Low vacancy rates equals greater cashflow as well as equity growth, which translates to higher returns for our investors.

Demand for apartments is at an all-time high and still climbing

Since its peak in the mid-2000s (see graph below), home ownership has been significantly dropping and it will continue to drop as millennials and the aging baby boomers want to stay mobile in the 21st century.

Vacancy rates remain low due to increased demand

With demand for apartments is at an all-time high, population is continuing to increase which drives the demand for apartment living higher and higher. Low vacancy rates equals greater cashflow as well as equity growth, which translates to higher returns for our investors.

See how our strategy make us different!

See How Our Strategy Make Us Different!

WV Capital Holdings does not make investment recommendations, and no communication through this website or in any other medium should be construed as such. Investment opportunities posted on this website are "private placements" of securities that are not publicly traded, are subject to holding period requirements, and are intended for investors who do not need a liquid investment. Private placement investments are NOT bank deposits (and thus NOT insured by the FDIC or by any other federal governmental agency), are NOT guaranteed by WV Capital Holdings and may lose value. Neither the Securities and Exchange Commission nor any federal or state securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through the website. Investors must be able to afford the loss of their entire investment. Any financial projections or returns shown on the website are estimated predictions of performance only, are hypothetical, are not based on actual investment results and are not guarantees of future results. Estimated projections do not represent or guarantee the actual results of any transaction, and no representation is made that any transaction will, or is likely to, achieve results or profits similar to those shown. Any investment information contained herein has been secured from sources that WV Capital Holdings believes are reliable, but we make no representations or warranties as to the accuracy of such information and accept no liability therefor. Offers to sell, or the solicitations of offers to buy, any security can only be made through official offering documents that contain important information about risks, fees and expenses. Investors should conduct their own due diligence, not rely on the financial assumptions or estimates displayed on this website, and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help you to understand and assess the risks associated with any investment opportunity. Investments in private placements involve a high degree of risk and may result in a partial or total loss of your investment. Private placements are generally illiquid investments. Investors should consult with their investment, legal, and tax advisors regarding any private placement investment.

QUICK LINKS

WV Capital Holdings specializes in value-add multifamily real estate and exhibits an expertise in maximizing value on every asset we acquire. Rather than attempting to predict the market cycles, we strive to acquire cash flowing apartment communities within medium and larger US metro.

© 2024 WV Capital Holdings. All Rights Reserved.